Finance

Citigroup Beats Estimates on Strong Trading Performance

Citigroup’s First-Quarter Results Exceed Analysts’ Estimates

Citigroup on Tuesday posted first-quarter results that exceeded analysts’ estimates as the firm’s traders generated more revenue than expected. The bank said profit rose 21% to $4.1 billion, or $1.96 per share, on higher revenues and lower expenses from the year-earlier period.

Thank you for reading this post, don't forget to subscribe!Key Highlights of the Report

Here’s what the company reported:

- Earnings: $1.96 per share vs. $1.85 per share LSEG estimate

- Revenue: $21.60 billion, vs. $21.29 billion expected

Companywide revenue climbed 3% to $21.60 billion as the firm cited gains in its five major divisions.

CEO Jane Fraser’s Statement

CEO Jane Fraser said the bank was continuing to earn credibility with investors and that she remains focused on executing on her strategy, which includes a "diversified business mix and will perform in a wide variety of macro scenarios." She also seemed to address recent concerns about the U.S. economy that have surfaced as President Donald Trump sought to restructure deals with America’s trading partners.

Economic Outlook

Fraser expressed confidence in the U.S. economy, stating, "When all is said and done, and longstanding trade imbalances and other structural shifts are behind us, the U.S. will still be the world’s leading economy, and the dollar will remain the reserve currency."

Comparison with Other Banks

JPMorgan Chase, Morgan Stanley, and Goldman Sachs each exceeded analysts’ estimates on a boom in equities trading revenue as the banks took advantage of volatility in the quarter. Shares of Citigroup have dropped 10% this year amid a broad selloff in banks related to President Donald Trump’s tariff policies.

Conclusion

Citigroup’s first-quarter results demonstrate the bank’s ability to generate revenue and profit in a volatile market. With a diversified business mix and a strong strategy, the bank is well-positioned to perform in a wide range of economic scenarios. Despite concerns about the U.S. economy, CEO Jane Fraser remains confident in the bank’s ability to earn credibility with investors and execute on its strategy. As the banking industry continues to evolve, Citigroup’s results will be closely watched by investors and analysts alike.

Finance

Stocks with significant premarket movements: Pinterest, Lyft, Coinbase, BP, Affirm and others

These are the stocks posting the largest moves in premarket trading

Introduction

As the stock market opens for the day, investors are keeping a close eye on premarket trading to see which stocks are making big moves before the market officially opens. Pre-market trading can give investors a glimpse into how a stock will perform once the market opens, making it a crucial time for many traders.

Thank you for reading this post, don't forget to subscribe!Top Stocks in Premarket Trading

1. Tesla Inc. (TSLA)

- Tesla is one of the most talked-about stocks in premarket trading today, with a significant increase in volume and price movement.

- Investors are closely watching Tesla as the company continues to dominate the electric vehicle market and expand its operations globally.

- The stock has been known for its volatility, making it a favorite among day traders looking for quick gains.

2. Apple Inc. (AAPL)

- Apple is another stock that is making waves in premarket trading, with investors eagerly awaiting the latest news on new product releases and sales figures.

- The tech giant is known for its consistent performance and loyal customer base, making it a popular choice for long-term investors.

- With the recent announcement of new iPhone models and updates to its software, Apple is expected to continue its upward trajectory in the stock market.

3. Amazon.com Inc. (AMZN)

- Amazon is a behemoth in the e-commerce industry, and its stock is reflecting that in premarket trading with strong gains.

- The company’s diverse business model and strong leadership have made it a favorite among investors looking for stable returns.

- As more consumers turn to online shopping, Amazon is poised to continue its growth and expand into new markets.

Why Pre-market Trading Matters

Premarket trading can give investors valuable insights into how a stock will perform once the market officially opens. By monitoring premarket activity, investors can make informed decisions about buying, selling, or holding onto their positions. It also allows traders to react quickly to breaking news or market trends that may impact a stock’s performance.

Additionally, premarket trading can be a good indicator of market sentiment and overall investor confidence. If a stock is seeing strong gains in premarket trading, it may signal that investors are optimistic about the company’s future prospects. On the other hand, if a stock is experiencing losses in premarket trading, it could indicate concerns about the company’s performance or external factors affecting the market.

Conclusion

Overall, premarket trading is an important time for investors to gauge market sentiment and make informed decisions about their investments. By keeping a close eye on which stocks are posting the largest moves in premarket trading, investors can stay ahead of the curve and position themselves for success in the stock market.

Finance

Kiir supports the recommendations of the 17 Trade Forum

The First National Trade Forum in South Sudan: A Step Towards Economic Recovery

Introduction

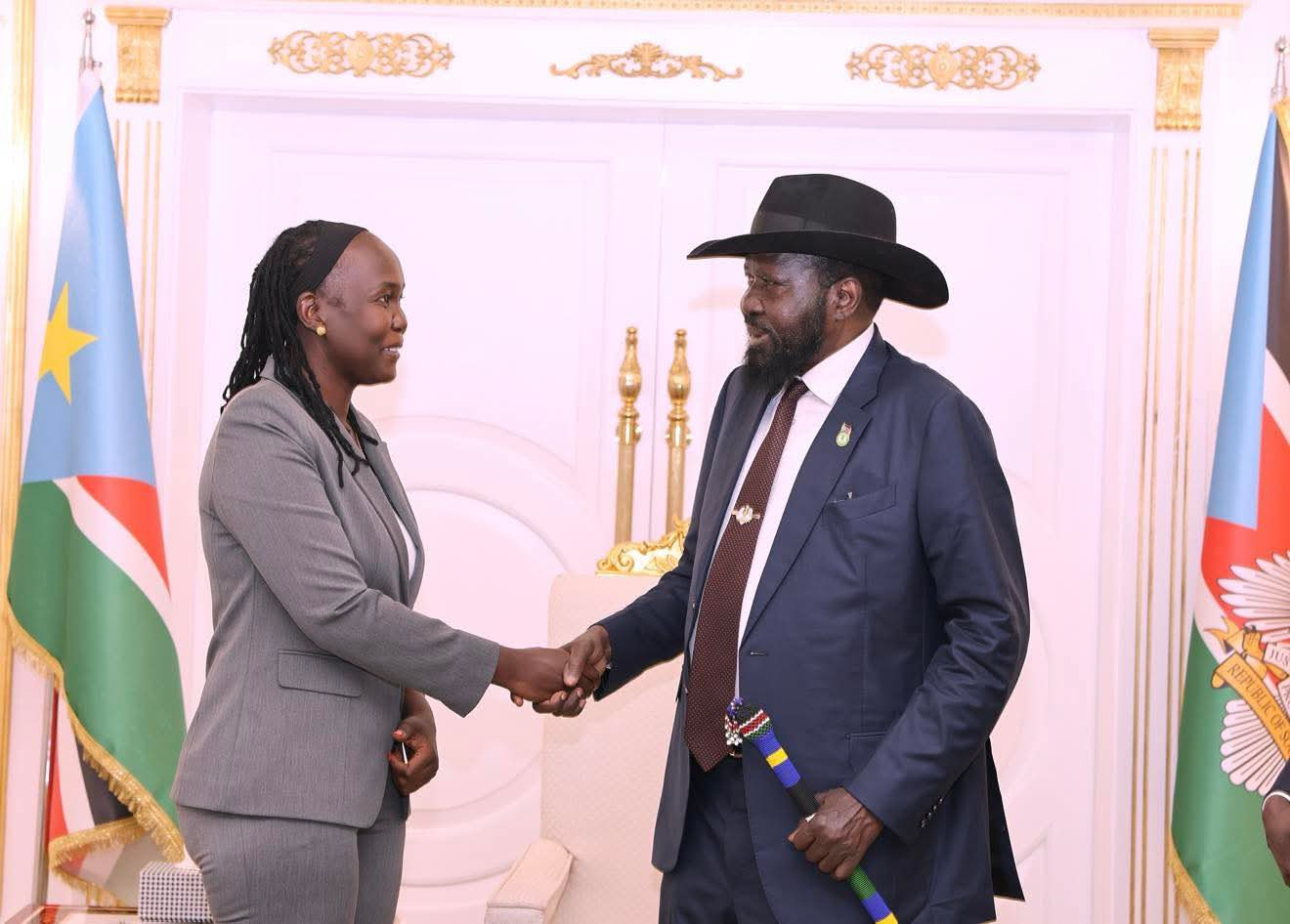

President Salva Kiir has endorsed the 17 recommendations adopted at South Sudan’s First National Trade Forum ended in Juba last month. The forum came out with several resolutions, including connecting affordable and consistent electricity across the country, removal of illegal checkpoints, and initiation of legal system reforms to support businesses, and better loan accessibility for locals.

Thank you for reading this post, don't forget to subscribe!Focus on Economic Growth

The forum, organized by the Ministry of Trade and Industry, focused on fostering economic growth, attracting investment, and improving South Sudan’s business environment. The goal was to create a more conducive environment for businesses to thrive and contribute to the country’s overall economic development.

President Kiir’s Commitment

In his remarks after receiving the document from Minister Atong Kuol Manyang, President Kiir acknowledged the concerns and assured the business community of the government’s commitment to supporting reforms that reduce trade barriers, stabilize markets, and restore investor confidence. He emphasized the importance of empowering local traders and urged the Ministry to prioritize policies that benefit the broader population and stimulate economic growth.

National Trade Forum Launch

On 24 April 2025, South Sudan launched its first National Trade Forum, convening investors from the private and public sectors to brainstorm ways to address the country’s persistent economic challenges. The two-day event held under the theme Understanding Private Sector Challenges and Solutions on Matters that Affect the Business Environment for Sustainable Consultation.

Key Challenges Identified

During her opening remarks at the forum, Minister Atong identified weak information technology, inadequate infrastructure, and ongoing conflict as key drivers of economic instability in the East African nation. She also highlighted illegal taxes and excessive roadblocks as key issues undermining economic stability. These barriers have been causing traders to raise commodity prices to offset their losses, further reducing the purchasing power of ordinary citizens.

Conclusion

The First National Trade Forum in South Sudan marks a significant step towards economic recovery and growth in the country. By addressing key challenges, fostering investment, and implementing reforms to support businesses, the government is paving the way for a more prosperous future for all South Sudanese. With a commitment to empowering local traders and prioritizing policies that benefit the broader population, the forum sets a positive tone for the country’s economic development.

Finance

Water prices to increase by 50% announces water purification companies

Water Prices in Juba Spike by 50% Due to Rising Production Costs

Reasons Behind the Price Hike

- The Water Abstraction Company Association Group has increased water prices by 50% in Juba.

- This hike is attributed to the high cost of production, including electricity and water purification chemicals.

- The rising exchange rate of the U.S. dollar has also impacted the cost of production.

Impact on Consumers

- Consumers in Juba now face almost double the initial price imposed by private water distribution companies.

- A 30-drum tanker truck that used to sell at SSP28,000 is now SSP42,000.

- A tanker truck with a capacity of 15 drums that initially sold at SSP13,000 is now SSP21,000.

- This represents a 50% hike in less than two months.

Concerns and Reactions

- SSUWC Director Yar Paul Kuol emphasized that selling water at the previous price would lead to operational losses.

- Edmond Yakani, Executive Director of CEPO, called on the government to intervene for the welfare of citizens.

- Yakani questioned the sharp increase in water prices due to electricity costs and access to hard currency.

Government Intervention Needed

- With the sharp increase in water prices affecting consumers in Juba, there is a need for government intervention.

- Yakani urged the leadership at various levels to review the issue of water price hikes blamed on electricity costs.

- The access to hard currency should not create an economic burden for the residents of Juba.

Conclusion

- The spike in water prices in Juba has put a strain on consumers, with prices almost doubling in a short period.

- The reasons behind the price hike, including high production costs and the exchange rate of the U.S. dollar, have impacted the affordability of water for residents.

- Government intervention is needed to address the issue and ensure the welfare of citizens in Juba.

Health2 weeks ago

Health2 weeks agoWarrap State Cholera Outbreak 2025: Crisis Deepens Amid Rising Death Toll

Africa2 weeks ago

Africa2 weeks agoSouth Sudan on the Brink of Civil War: Urgent Call for Peace Amid Rising Tensions

Health2 weeks ago

Health2 weeks agoWarrap State Cholera Outbreak: How Urgent Home Care Can Save Lives

Sudan3 weeks ago

Sudan3 weeks agoSudan Army Thwarts RSF Drone Attacks

Africa3 weeks ago

Africa3 weeks agoMali Officials Shut Down Barrick Gold’s Office Amid Tax Dispute

Africa3 weeks ago

Africa3 weeks agoInvestment App Freezes Users Out, Sparking Savings Loss Fears

Entertainment3 weeks ago

Entertainment3 weeks agoEntertainment Needs Corporate Support

South Sudan1 week ago

South Sudan1 week agoSPLA Battles Against SAF: Complete Timeline of Commanders & Towns (1983-2005)